Pension forecasts

The pension forecast is ATP’s best estimate of what you can expect to receive from ATP when you retire.

How much will I receive in pension?

The amount of ATP Livslang Pension you can expect to receive depends on how much you have contributed over the years. The overview of your ATP Livslang Pension shows how much you have contributed and how much you can expect to receive in pension from ATP. Regardless of when you check the overview of your ATP Livslang Pension, it will always provide the most accurate picture of what you can expect to receive.

Uncertainty in the calculation of your pension payment

The calculation is based on a series of common assumptions and expectations on the rate of return, inflation, life expectancy and tax. We cannot predict exactly how these factors will develop in the future. Therefore, we cannot say precisely how much pension you will receive.

Returns uncertainty

To give you an idea of the uncertainty, we also calculate the pension payment at a high rate of return and the pension payment at a low rate of return. The two numbers show your pension payments if financial market developments are better or worse than expected. Only the uncertainty regarding the financial market developments has been included in the calculation of the pension payment at a high rate of return and the pension payment at a low rate of return. Uncertainty about inflation, tax rules, life expectancy, etc. is not included.

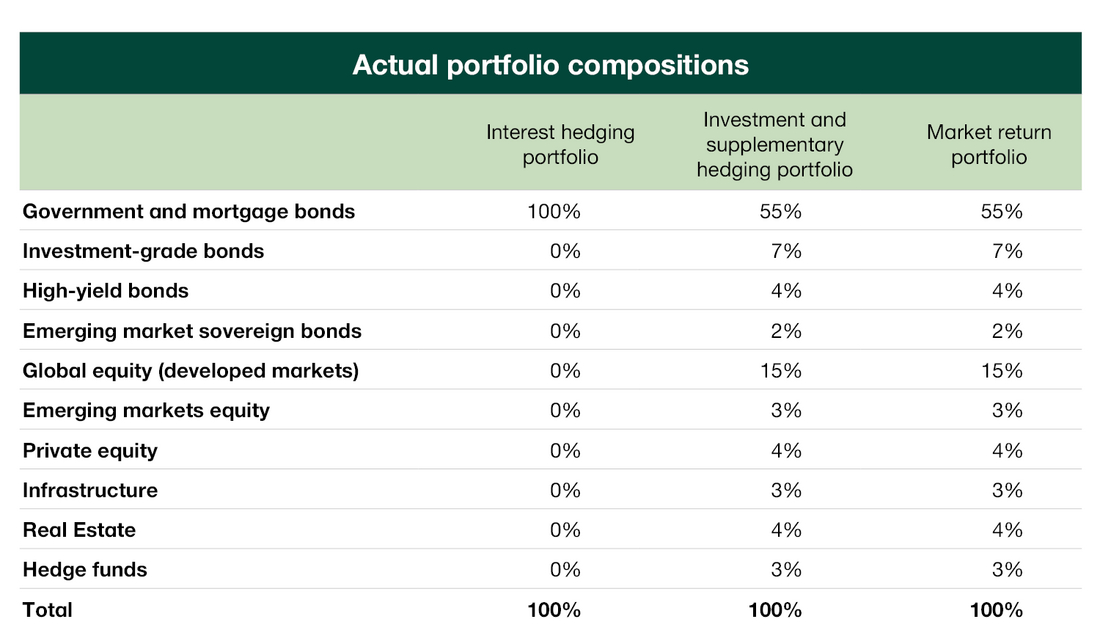

Portfolio information

ATP’s pension forecast is based on ATP’s actual investment portfolio. The portfolio is broken down into 10 asset classes defined by Insurance & Pension Denmark’s (Forsikring og Pension) common projection assumptions (Samfundsforudsætninger).

Portfolio weight

Breakdown of ATP’s actual investment portfolio as of December 31, 2025: